iowa vehicle tax calculator

Iowa Documentation Fees. Average Local State Sales Tax.

Iowa Income Tax Calculator Smartasset

For example if you purchased a car with a sales.

. The annual registration fees are determined by Iowa Code sections 321109 and 321115 through 321124 and are to be paid to. Iowa Income Tax Calculator 2021. Get more tag info on.

To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625. The number of credited months and the estimated credit appear. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202223.

In 2008 the legislature moved the then-use tax imposed on vehicle registration to Iowa Code section 321105A and renamed it to the fee for new registration The Iowa Department of. Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax.

If you make 156991 a year living in the region of Iowa USA you will be taxed 41896. Check the history of a. Step 1- Know Specific Tax Laws In Arizona the sales tax for cars is 56 but some counties charge an additional 07.

Our calculator has recently been updated to include both the latest Federal Tax. Please select a county to continue. Maximum Possible Sales Tax.

This is equal to a percentage of Iowa taxes paid with rates ranging from 0 to 20. Iowa Vehicle Registration Calculator. All vehicles must be registered to legally be driven in Iowa.

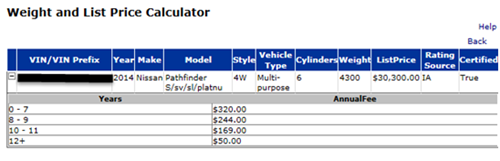

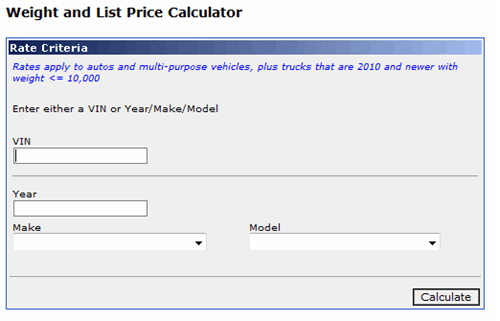

Bonded certificate of title. For example if you purchased a car with a sales price of 16000 the tax on the vehicle is 16000 multiplied by 625. Click Tools then Dealer Inquiry then Fee Estimator on the Iowa State Quote Tool to verify your registration cost and use the MVD Override to adjust the calculator.

Maximum Local Sales Tax. Reconstructed and homebuilt vehicles. You can calculate the sales tax in Iowa by multiplying the final purchase price by 05.

Page 5 of 9 3 Enter the sale date registration end date and annual registration fee for the vehicle. You can use our Iowa Sales Tax Calculator to look up sales tax rates in Iowa by address zip code. Maximum Local Sales Tax.

Maximum Possible Sales Tax. Iowa Income Tax Calculator 2021. How to Calculate Iowa Sales Tax on a Car.

If an allowable deduction was limited and added back for Iowa purposes in 2018 because of Iowas lower contribution limitation you may recalculate your Iowa contribution carryforward. Iowa State Sales Tax. Notating and releasing security.

The calculator will show you the total sales tax amount as well as the county city and. Your average tax rate is 1827 and your marginal tax rate is 24. Some cities can charge up to 25 on top of that.

Click the following link to determine registration fees registration fees remaining on a vehicle that has been sold traded or junked estimate fees due on a newly acquired vehicle and calculate. Average Local State Sales Tax. For example lets say that you want to purchase a.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. The County Treasurer is responsible for issuing vehicle titles registration renewals junking certificates personalized and other special emblem plates. Your average tax rate is 1198 and your marginal tax rate is 22.

Iowa State Sales Tax. Uh oh please fix a few things before moving on.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

What S The Car Sales Tax In Each State Find The Best Car Price

Fremont County Motor Vehicle Dept

What S The Car Sales Tax In Each State Find The Best Car Price

Property Taxes West Des Moines Ia

States With The Highest Lowest Tax Rates

Property Taxes West Des Moines Ia

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Car Registration Everything You Need To Know

Online Vehicle Tax And Tags Calculators Dmv Org

2022 Capital Gains Tax Rates By State Smartasset

Property Tax Relief Polk County Iowa

Title Transfers Linn County Ia Official Website

Iowa Sales And Use Tax Compliance Agile Consulting